Each year, millions of Americans look forward to receiving their tax refunds. For many households, this refund provides helpful financial support for paying bills, building savings, or covering planned expenses. As the 2026 tax season moves forward, understanding the expected refund timeline can help taxpayers manage their finances more effectively.

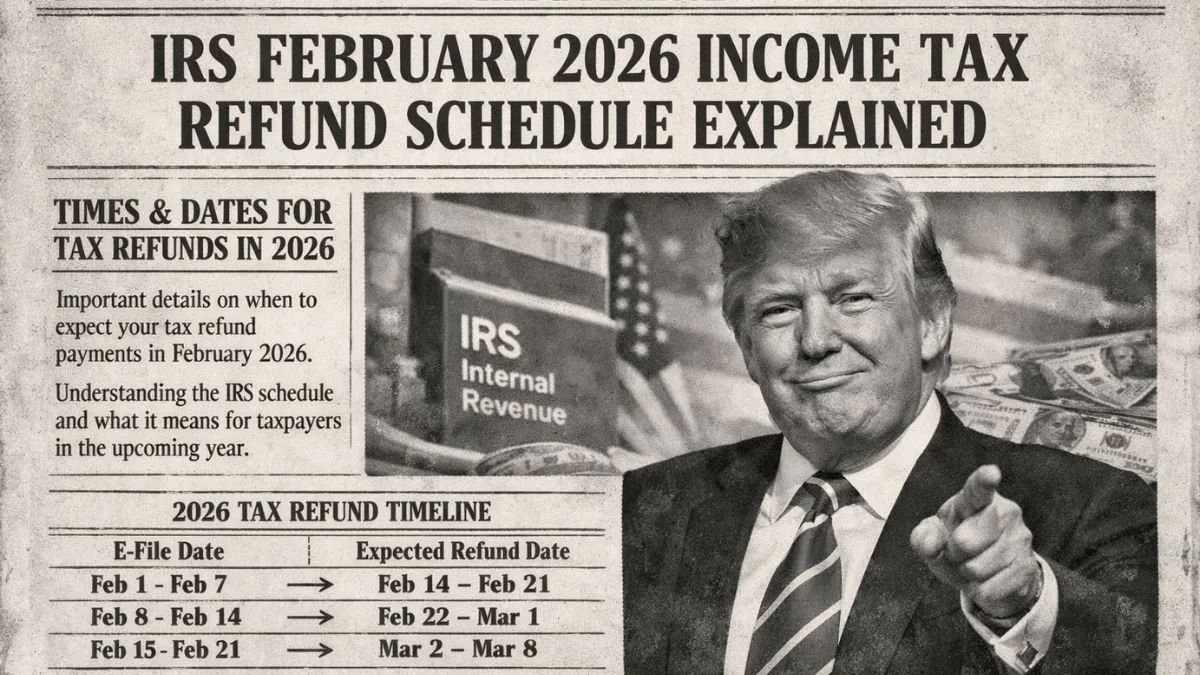

The Internal Revenue Service began accepting and processing 2025 tax year returns in late January 2026. In most cases, taxpayers who file their returns electronically and choose direct deposit can expect to receive their refund within about 21 days after the IRS accepts the return. Direct deposit remains the fastest and safest way to receive funds compared to waiting for a paper check in the mail.

Refund timing depends on several important factors. The date you file, the accuracy of your information, and the payment method you select all influence how quickly your money arrives. Returns that contain errors, missing information, or identity verification issues may require additional review, which can delay processing. Paper-filed returns generally take longer than electronic submissions because they must be manually handled.

Taxpayers who claim certain credits may also experience delays. Those who apply for the Earned Income Tax Credit or the Additional Child Tax Credit are subject to special review rules under federal law. The IRS is required to hold these refunds until mid-February to verify eligibility and prevent fraud. As a result, affected taxpayers typically see their refunds issued later in February, even if they filed early.

The IRS provides online tools that allow taxpayers to track their refund status. Individuals can begin checking their refund status 24 hours after e-filing or about four weeks after mailing a paper return. The tracking system updates daily and shows whether the return has been received, approved, or sent.

For the 2026 tax season, the IRS has improved its processing systems to enhance efficiency and accuracy. Many taxpayers who file early and use direct deposit may experience faster processing compared to previous years. However, officials advise allowing extra time in case of verification steps or technical delays.

यह भी पढ़े:

Social Security Benefits 2026 Update: COLA Outlook, Payment Amount Reality, and What Is Official

Social Security Benefits 2026 Update: COLA Outlook, Payment Amount Reality, and What Is Official

Filing early, reviewing your return carefully before submission, and choosing direct deposit are the best ways to receive your refund as quickly as possible. While most refunds are processed within three weeks, it is wise to remain flexible in case unexpected delays occur.

Disclaimer: This article is for informational purposes only. Refund timelines and payment dates depend on individual tax situations and official IRS processing. Taxpayers should verify details through official IRS resources or consult a qualified tax professional for personalized guidance.