In recent weeks, many Americans have heard claims about a possible $2,000 payment from the Internal Revenue Service in February 2026. Social media posts and online headlines have raised hopes about a new stimulus check. However, it is important to understand what is officially confirmed and what is simply speculation.

At this time, there is no nationwide $2,000 stimulus program officially announced for February 2026. The federal government has not approved a new universal direct payment of this amount. When Congress authorizes a stimulus program, it is publicly announced with clear eligibility rules, timelines, and payment methods. No such formal announcement has been made regarding a new $2,000 federal payment for all Americans.

In many cases, the $2,000 figure being discussed is likely connected to regular tax refunds. When taxpayers file their 2025 federal tax returns in early 2026, some may receive refunds close to or above $2,000. This amount depends on income, tax withholdings, and credits claimed. Refundable credits such as the Child Tax Credit or Earned Income Tax Credit can significantly increase refund totals for eligible families.

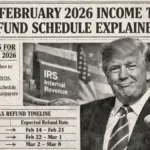

For those who file their tax returns electronically and choose direct deposit, refunds are often processed within about 21 days after the return is accepted. Taxpayers who submit early in the filing season may see deposits in February. Those who request paper checks typically wait longer due to mailing and processing times.

Eligibility for any refund amount depends on several factors. These include annual income, filing status, number of dependents, and whether too much tax was withheld during the year. There is no automatic $2,000 payment sent to every American without meeting specific tax or credit requirements.

Taxpayers should monitor their refund status through the official IRS online tracking system after filing their returns. It is essential to use only trusted government platforms to avoid scams. Fraudulent websites may falsely promise early access to payments and request sensitive personal information. Social Security numbers and bank details should never be shared on unofficial sites.

Financial news can spread quickly, especially when large dollar amounts are mentioned. However, not every headline reflects a confirmed federal program. Americans should rely on official government announcements for accurate updates.

Disclaimer: Payment amounts, eligibility rules, and deposit dates depend on individual tax situations and official government approval. Readers should verify information through the official IRS website or consult a qualified tax professional before making financial decisions.